The Jamaican dollar slipped in value against the US dollar, with the local currency losing 4 cents foreign currency trading on Wednesday, with heavy trading in excess of US$65 million.

The Jamaican dollar slipped in value against the US dollar, with the local currency losing 4 cents foreign currency trading on Wednesday, with heavy trading in excess of US$65 million.

On Wednesday, the rate the public bought the US dollar at, rose to $125.77 as dealers sold US$65.75 million in US currency, compared US$44.14 million at an average rate of $125.73 on Tuesday. US currency purchases by dealers, amounted to US$59.18 million on Wednesday, at an average rate of $124.85, compared to Tuesday, with US$48.74 million at $124.77.

On Wednesday at midday dealers purchased US$12.01 million at an average rate of J$125.11 and sold US$9.08 million at an average of J$125.85.

At mid-day on Tuesday dealers purchased US$12.31 million at an average rate of J$125.14 while they sold US$3.83 million at an average of J$125.71.

Dealers’ purchased US$65.32 million, versus US$61.43 million on Tuesday in all currencies in Jamaica’s Forex market and sold US$69.63 million compared with US$54.44 million sold, previously.

The selling rate for the Canadian dollar rose to J$97.86 from J$97.82 at the close on Tuesday. The selling rate for the British Pound slipped to J$166.67 versus J$166.83 previously and the euro rose in value against the Jamaican dollar at J$147.89 to buy the European common currency, versus the prior selling rate of J$146.99.

Jamaican$ falls in heavy trading- Wednesday

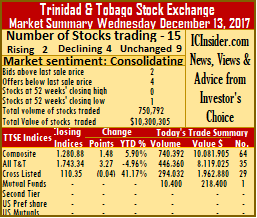

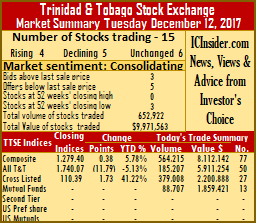

TTSE close in calmer waters – Wednesday

Republic Bank drops to 52 weeks’ low.

Price movements were calmer at the close of trading on the Trinidad & Tobago Stock Exchange on Wednesday with 2 stocks advancing, 4 declining and 9 unchanged as 15 securities traded for the third consecutive day.

The market closed as 750,792 shares traded at a value of $10,300,305 compared to Tuesday’s trades of 652,922 shares valued at $9,971,563.

The Composite Index gained 1.48 points to 1,280.88, the All T&T Index advanced by 3.27 points to 1,743.34 and the Cross Listed Index lost 0.04 points to close at 110.35.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended with 2 stocks with bids higher than last selling prices and 4 with lower offers.

Gains| At the close of trading on Wednesday, National Enterprises gained 25 cents to end at $10 trading 242,340 shares valued at $2,423,050 and Trinidad & Tobago NGL rose 50 cents to close at $26.50 exchanging 24,334 shares valued at $641,925.

Losses| The last traded prices of the securities declining are, First Citizens with a loss of 1 cent, in closing at $32 with 134,288 shares valued at $4,298,539, Guardian Holdings trading at $17.98, with a loss of 1 cent swapping 500 units, JMMB Group ending at $1.59, after losing 1 cent with 83,033 shares changing hands and Republic Financial Holdings that closed 25 cents lower to a new 52 weeks’ low of $100 with 549 units changing hands.

Losses| The last traded prices of the securities declining are, First Citizens with a loss of 1 cent, in closing at $32 with 134,288 shares valued at $4,298,539, Guardian Holdings trading at $17.98, with a loss of 1 cent swapping 500 units, JMMB Group ending at $1.59, after losing 1 cent with 83,033 shares changing hands and Republic Financial Holdings that closed 25 cents lower to a new 52 weeks’ low of $100 with 549 units changing hands.

Firm Trades| The last prices of securities at the close on Wednesday unchanged are, Angostura Holdings that closed at $15 with 42,437 units valued at $636,555 trading, while Clico Investment remained at $21 with 10,400 shares and First Caribbean International Bank ending trading at $9.30, with 127,150 stock units valued at $1,182,495 being exchanged. Massy Holdings closed at $49 with a mere 10 units traded, NCB Financial Group held firm at $6.50, exchanging 12,561 shares while One Caribbean Media closed at $14 with 1,000 units. Sagicor Financial settled at $7.95 with 71,288 shares valued at $566,740, Scotiabank closed at $61 with 436 units trading and Unilever Caribbean remained flat at $30 with of 466 units trading

VM Investments 2 times over

Yet another Initial Public Offering crossed the line with demand exceeding supply as the latest issue by VM Investments to raise just under $700 million, has been oversubscribed and closed at the end on Tuesday.

Yet another Initial Public Offering crossed the line with demand exceeding supply as the latest issue by VM Investments to raise just under $700 million, has been oversubscribed and closed at the end on Tuesday.

“We were heartened by the overwhelming confidence demonstrated by Members of the Victoria Mutual family and the wider public. We closed today with subscriptions in excess of $2 Billion for the $689,261,487 offer” Devon Barrett, Victoria Mutual Group’s Chief Investment Officer said.

Barrett went on to say “we believe this augurs well for Jamaica’s economic growth and look forward to contributing to this growth by providing financing solutions for small and medium-sized entities in Jamaica. Details on the basis for allocation will be communicated to the Jamaica Stock Exchange in a subsequent advisory.”

Devon Barrett CEO of VMIL addressing invitees at the formal announcement of the IPO

A total of 225,003,750 Ordinary Shares in the Offer are initially reserved for staff and customers of the VMBS Group at discounts from $2.08 to $2.33 each and 75 million for the general public at $2.45 each. The offer which opens on December 11, was scheduled to close on December 18.

The company reported profit after taxes of $326 million, surpassing the $310 million made in 2015 and up to September profit of $273 million was achieved putting in on track for $360 for the year or 30 cents per share with PE ratio of 8, which is well below the average of the market 14.

Last week, FosRich and GWest closed with the issue oversubscribed and Wisynco closed with over $17 billion chasing a little more than $6 billion that was sought. Reports are that the Wisynco offer was heavily subscribed to by institutional investors.

Jamaican$ value eased – Tuesday

The Jamaican dollar slipped in value against the US dollar, with the local currency losing 3 cents foreign currency trading on Tuesday, with inflows rising over Monday’s intake and ending higher than outflows.

The Jamaican dollar slipped in value against the US dollar, with the local currency losing 3 cents foreign currency trading on Tuesday, with inflows rising over Monday’s intake and ending higher than outflows.

On Tuesday, the rate the public bought the US dollar at, rose to $125.73 as dealers sold US$44.14 million in US currency, compared US$45.34 million at an average rate of $125.70 on Monday. US currency purchases by dealers amounted to US$48.74 million on Tuesday, at an average rate of $124.77, compared to Monday, with US$46.94 million at $124.68.

On Tuesday at midday dealers purchased US$12.31 million at an average rate of J$125.14 and sold only US$3.83 million at an average of J$125.71.

At mid-day on Monday dealers purchased US$22.58 million at an average rate of J$125.14 while they sold US$22.48 million at an average of J$125.71.

Dealers’ purchased US$61.43 million, versus US$59.08 million on Monday in all currencies in Jamaica’s Forex market and sold US$54.44 million compared with US$55.58 million sold, previously.

The selling rate for the Canadian dollar slipped to J$97.82 from J$97.93 at the close on Monday. The selling rate for the British Pound dropped to J$166.83 versus J$168.13 previously and the euro fall in value against the Jamaican dollar at J$146.99 to buy the European common currency, versus the prior selling rate of J$149.74.

More gains for Jamaican$ – Monday

The Jamaican dollar continued to gain in value against the US dollar, at the start of the week with the local currency gained in foreign currency trading on Monday, with inflows rising over Friday’s intake and ending higher than outflows.

The Jamaican dollar continued to gain in value against the US dollar, at the start of the week with the local currency gained in foreign currency trading on Monday, with inflows rising over Friday’s intake and ending higher than outflows.

On Monday, the rate the public bought the US dollar at, fell to $125.70 as dealers sold US$45.34 million in US currency, compared US$50.39 million at an average rate of $125.82 on Friday. US currency purchases by dealers amounted to US$46.94 million on Monday, at an average rate of $124.68, compared to Friday, with US$40.20 million at $124.83.

On Monday at midday dealers purchased US$22.58 million at an average rate of J$125.14 and sold US$22.48 million at an average of J$125.71. At mid-day on Friday dealers purchased US$13.5 million at an average rate of J$125.27 while they sold US$16.47 million at an average of J$125.83.

Dealers’ purchased US$59.08 million, versus US$51.76 million on Friday in all currencies in Jamaica’s Forex market and sold US$55.58 million compared with US$63.86 million sold, previously.

The selling rate for the Canadian dollar rose to J$97.93 from J$98.31 at the close on Friday. The selling rate for the British Pound slipped to J$168.13 versus J$168.91 previously and the euro rose in value against the Jamaican dollar at J$149.74 to buy the European common currency, versus the prior selling rate of J$146.96.

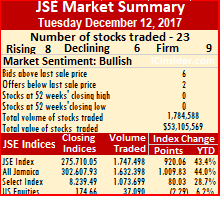

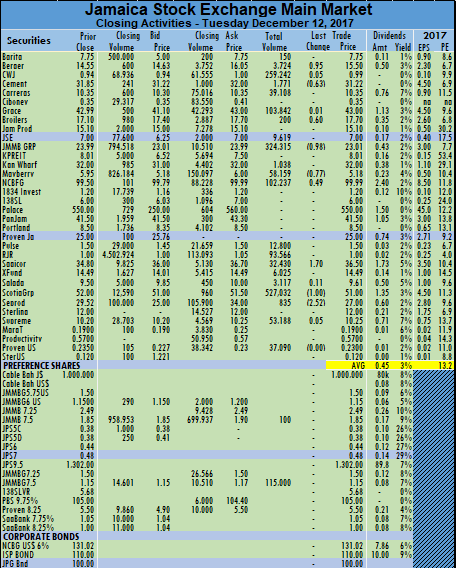

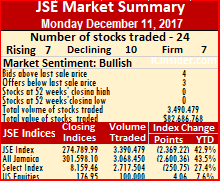

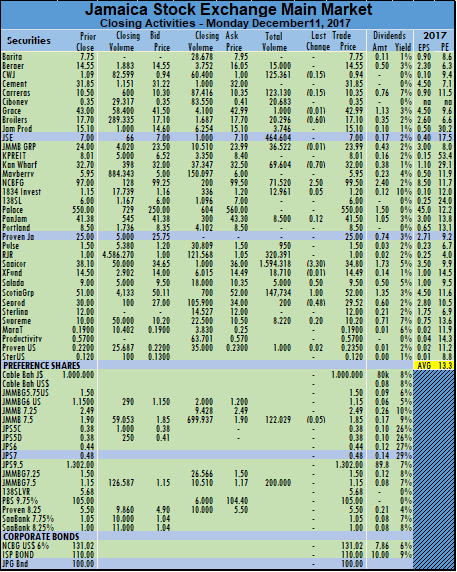

At the close of the Main Market activity on the Jamaica Stock Exchange on Tuesday, 22 securities changed hands, of which 8 advanced, 5 declined and 7 traded firm as 1,747,498 units valued at $52,030,701 traded.

At the close of the Main Market activity on the Jamaica Stock Exchange on Tuesday, 22 securities changed hands, of which 8 advanced, 5 declined and 7 traded firm as 1,747,498 units valued at $52,030,701 traded.  Caribbean Cement ended trading with a loss of 63 cents at $31.22, with 1,771 stock units, Carreras traded at $10.35, with 39,108 units. Grace Kennedy closed 1 cent higher at $43, with 103,842 shares, Jamaica Broilers ended 60 cents higher at $17.70, with 200 stock units, Jamaica Stock Exchange finished at $7, with 9,619 shares changing hands, JMMB Group settled with a loss of 98 cents at $23.01, with 324,315 shares. Kingston Wharves traded at $32, with 1,038 units trading, Mayberry Investments finished trading with a loss of 77 cents at $5.18, with 58,159 shares, NCB Financial Group closed 49 cents higher at $99.99, with 102,237 shares changing hands, Pulse Investments settled at $1.50, with 12,800 shares. Radio Jamaica ended trading at $1, with 93,566 stock units, Sagicor Group traded $1.70 higher at $36.50, with 32,430 units,

Caribbean Cement ended trading with a loss of 63 cents at $31.22, with 1,771 stock units, Carreras traded at $10.35, with 39,108 units. Grace Kennedy closed 1 cent higher at $43, with 103,842 shares, Jamaica Broilers ended 60 cents higher at $17.70, with 200 stock units, Jamaica Stock Exchange finished at $7, with 9,619 shares changing hands, JMMB Group settled with a loss of 98 cents at $23.01, with 324,315 shares. Kingston Wharves traded at $32, with 1,038 units trading, Mayberry Investments finished trading with a loss of 77 cents at $5.18, with 58,159 shares, NCB Financial Group closed 49 cents higher at $99.99, with 102,237 shares changing hands, Pulse Investments settled at $1.50, with 12,800 shares. Radio Jamaica ended trading at $1, with 93,566 stock units, Sagicor Group traded $1.70 higher at $36.50, with 32,430 units,  Sagicor Real Estate Fund finished trading at $14.49, with 6,025 shares, Salada Foods Jamaica closed 11 cents higher at $9.61, with 3,117 shares. Scotia Group ended with a loss of $1 at $51, with 527,032 stock units trading, Seprod dived $2.52 t0 $27, with just 835 units changing hands and Supreme Ventures settled 5 cents higher at $10.25, with 53,188 shares. In the main market preference segment, Jamaica Money Market Brokers 7.5% traded just 100 units at $1.85 and JMMB Group 7.5% ended trading at $1.15, with 115,000 units trading.

Sagicor Real Estate Fund finished trading at $14.49, with 6,025 shares, Salada Foods Jamaica closed 11 cents higher at $9.61, with 3,117 shares. Scotia Group ended with a loss of $1 at $51, with 527,032 stock units trading, Seprod dived $2.52 t0 $27, with just 835 units changing hands and Supreme Ventures settled 5 cents higher at $10.25, with 53,188 shares. In the main market preference segment, Jamaica Money Market Brokers 7.5% traded just 100 units at $1.85 and JMMB Group 7.5% ended trading at $1.15, with 115,000 units trading.

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with bids higher than the last selling prices and 4 with lower offers.

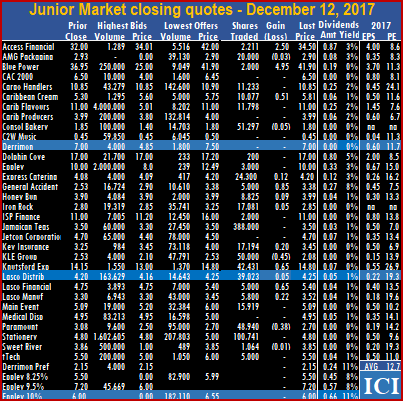

IC bid-offer Indicator| At the end of trading, the Investor’s Choice bid-offer indicator reading shows 3 stocks ending with bids higher than the last selling prices and 4 with lower offers. KLE Group ended trading with a loss of 45 cents at $2.08, with 50,000 stock units. Knutsford Express traded 65 cents higher at $14.80, with 42,431 units, Lasco Distributors finished trading 5 cents higher at $4.25, with 39,023 shares, Lasco Financial closed 65 cents higher at $5.40, with 5,000 shares, Lasco Manufacturing ended 22 cents higher at $3.52, with 5,800 stock units. Main Event concluded trading at $5.09, with 15,919 units, Paramount Trading settled with a loss of 38 cents at $2.70, with 48,940 shares, Stationery and Office ended trading at $4.80, with 100,741 stock units, Sweet River traded with a loss of 1 cent at $3.85, with 1,064 units and tTech finished trading at $5.50, with 5,000 shares.

KLE Group ended trading with a loss of 45 cents at $2.08, with 50,000 stock units. Knutsford Express traded 65 cents higher at $14.80, with 42,431 units, Lasco Distributors finished trading 5 cents higher at $4.25, with 39,023 shares, Lasco Financial closed 65 cents higher at $5.40, with 5,000 shares, Lasco Manufacturing ended 22 cents higher at $3.52, with 5,800 stock units. Main Event concluded trading at $5.09, with 15,919 units, Paramount Trading settled with a loss of 38 cents at $2.70, with 48,940 shares, Stationery and Office ended trading at $4.80, with 100,741 stock units, Sweet River traded with a loss of 1 cent at $3.85, with 1,064 units and tTech finished trading at $5.50, with 5,000 shares.

In trading elsewhere, the market closed with 15 securities changing hands, the same as on Monday with 4 stocks advancing, 5 declining and 6 holding firm. A total of 652,922 shares traded at a value of $9,971,563 compared to Monday’s trades of 176,689 valued at $5,273,498.

In trading elsewhere, the market closed with 15 securities changing hands, the same as on Monday with 4 stocks advancing, 5 declining and 6 holding firm. A total of 652,922 shares traded at a value of $9,971,563 compared to Monday’s trades of 176,689 valued at $5,273,498.

JMMB Group settled with a loss of 1 cent at $23.99, with 36,522 shares, Kingston Wharves traded with a loss of 70 cents at $32, with 69,604 units, NCB Financial Group closed $2.50 higher at $99.50, with 71,520 shares, 1834 Investments ended 5 cents higher at $1.20, with 12,961 stock units, PanJam Investment concluded trading 12 cents higher at $41.50, with 8,500 units. Pulse Investments settled at $1.50, with 950 shares, Radio Jamaica ended trading at $1, with 320,391 stock units, Sagicor Group traded with a loss of $3.30 at $34.80, with 1,594,318 units, Sagicor Real Estate Fund finished trading with a loss of 1 cent at $14.49, with 18,710 shares.

JMMB Group settled with a loss of 1 cent at $23.99, with 36,522 shares, Kingston Wharves traded with a loss of 70 cents at $32, with 69,604 units, NCB Financial Group closed $2.50 higher at $99.50, with 71,520 shares, 1834 Investments ended 5 cents higher at $1.20, with 12,961 stock units, PanJam Investment concluded trading 12 cents higher at $41.50, with 8,500 units. Pulse Investments settled at $1.50, with 950 shares, Radio Jamaica ended trading at $1, with 320,391 stock units, Sagicor Group traded with a loss of $3.30 at $34.80, with 1,594,318 units, Sagicor Real Estate Fund finished trading with a loss of 1 cent at $14.49, with 18,710 shares.  Salada Foods Jamaica closed 50 cents higher at $9.50, with 5,000 shares, Scotia Group ended $1 higher at $52, with 147,734 stock units, Seprod concluded trading with a loss of 48 cents at $29.52, with 200 units and Supreme Ventures settled 20 cents higher at $10.20, with 8,220 shares. In the main market preference segment, Jamaica Money Market Brokers 7.25% traded 122,029 units but fell 5 cents to $1.85 JMMB Group 7.5% ended trading at $1.15, with 200,000 stock units.

Salada Foods Jamaica closed 50 cents higher at $9.50, with 5,000 shares, Scotia Group ended $1 higher at $52, with 147,734 stock units, Seprod concluded trading with a loss of 48 cents at $29.52, with 200 units and Supreme Ventures settled 20 cents higher at $10.20, with 8,220 shares. In the main market preference segment, Jamaica Money Market Brokers 7.25% traded 122,029 units but fell 5 cents to $1.85 JMMB Group 7.5% ended trading at $1.15, with 200,000 stock units.