Consolidated Bakeries (Purity) make a loss in 2017 but could return to profit in 2018.

Profit melted away at Consolidated Bakeries for 2017 with a loss of $40 million down from a profit of $10 million in 2016 from sale revenues that slipped from $880 million to $863 million.

The company continued the loss right through to the year with a loss of $9 million before differed tax charge in the final quarter but the 2017 loss was lower than the loss of $20 million in the same period in 2016. Closer examination of the results show hope for the company going forward, into 2018

While revenues for the year fell 2 percent it rose 10 percent in the December quarter and helped to improve gross profit to 39 percent from just 31 percent in 2016 quarter. The 2017 final quarter was also much higher than the 35 percent for the full year.

Cost appeared mixed, with marketing and sales expenses rising 31 percent to $55 million and 17 percent to $158 million as this category of cost out stripped revenues by a big margin.

Administrative expenses fell 41 percent to $23 million in the quarter and fell 3 percent for the year to $158 million. Finance cost jumped in the quarter, to $16 million from $7 million, in 2016 and from $12 million to $19 million for the year.

Consolidated Bakeries Miss Birdie Easter bun.

Revaluation of the Jamaican dollar cost the company $4 in the final quarter and resulted in reduction in other income ending with a negative $2.5 million versus $5.5 in 2016 and just 875,000 for the full year versus $9 million, while the big jump in Finance cost in the December quarter seems to be one off, as such without these two items the company would have reported a profit for the quarter and augurs well for the 2018 results.

Gross cash flow was negative $7 million but growth in receivables, inventories, addition to fixed assets and drawn down on investments was offset by net loan inflows and increased payables and increased in bank overdraft ended at $74 million. At the end of December, shareholders’ equity stands at $716 million which was boosted by gain on revaluation of land and building by $206 million. Borrowings at just $135 million. Net current assets ended the period $92 million well over payables of $77 million.

Earnings per share was negative for the quarter and the fiscal year. The stock traded at $2 on the Junior Market of the Jamaica Stock Exchange with a PE ratio of 12 times 2018 estimated earnings of 17 cents. Earnings could be more if revenues were to increase above 10 percent for 2018.

Investors in Jamaica will get another opportunity to vote come mid April, on the merits of a new public share offer.

Investors in Jamaica will get another opportunity to vote come mid April, on the merits of a new public share offer. The company has a large nine-member board chaired by Gregory Pullen, Courtney Pullen, Melene Pullen, Garret Gardener, Nesha Carby, financier Mark Croskery, ex-banker Donovan Perkins, attorney-at-law Vivette Miller and Chartered Accountant Jennifer Lewis.

The company has a large nine-member board chaired by Gregory Pullen, Courtney Pullen, Melene Pullen, Garret Gardener, Nesha Carby, financier Mark Croskery, ex-banker Donovan Perkins, attorney-at-law Vivette Miller and Chartered Accountant Jennifer Lewis.

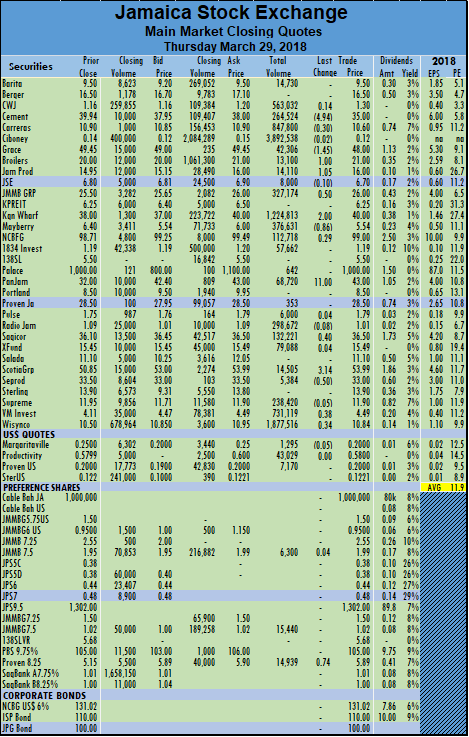

The US dollar market closed on Thursday with 51,494 units valued at over US$26,317.

The US dollar market closed on Thursday with 51,494 units valued at over US$26,317.  Jamaica Stock Exchange main market activity, closed on Thursday with more sharp price movements, including a drop of $4.94 in Caribbean Cement, a $11 jump in the price of PanJam Investment and a surge of $3.14 in Scotia Group share price.

Jamaica Stock Exchange main market activity, closed on Thursday with more sharp price movements, including a drop of $4.94 in Caribbean Cement, a $11 jump in the price of PanJam Investment and a surge of $3.14 in Scotia Group share price.  Radio Jamaica settled with a loss of 8 cents at $1.01, trading 298,672 shares, Sagicor Group ended trading 40 cents higher at $36.50, with 132,221 stock units, Sagicor Real Estate Fund rose 4 cents to end at $15.49, with 79,088 shares. Scotia Group jumped $3.14 to close at $53.99, with 14,505 shares trading, Seprod closed with a loss of 50 cents at $33, in the trading of 5,384 shares. Supreme Ventures concluded trading with a loss of 5 cents at $11.90, with 238,420 stock units, Victoria Mutual Investments finished 38 cents higher at $4.49, with 731,119 units changing hands, Wisynco Group settled 34 cents higher at $10.84, with 1,877,516 shares. In the main market preference segment, Jamaica Money Market 7.5% traded 4 cents higher at $1.99, with 6,300 stock units, JMMB Group 7.5% closed at $1.02, with 15,440 shares, Proven Investments jumped 74 cents to close at $5.89, with 14,939 units, changing hands.

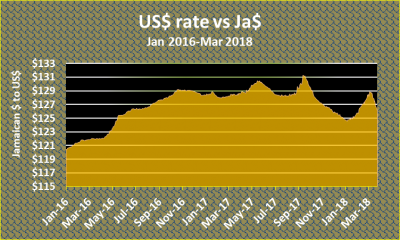

Radio Jamaica settled with a loss of 8 cents at $1.01, trading 298,672 shares, Sagicor Group ended trading 40 cents higher at $36.50, with 132,221 stock units, Sagicor Real Estate Fund rose 4 cents to end at $15.49, with 79,088 shares. Scotia Group jumped $3.14 to close at $53.99, with 14,505 shares trading, Seprod closed with a loss of 50 cents at $33, in the trading of 5,384 shares. Supreme Ventures concluded trading with a loss of 5 cents at $11.90, with 238,420 stock units, Victoria Mutual Investments finished 38 cents higher at $4.49, with 731,119 units changing hands, Wisynco Group settled 34 cents higher at $10.84, with 1,877,516 shares. In the main market preference segment, Jamaica Money Market 7.5% traded 4 cents higher at $1.99, with 6,300 stock units, JMMB Group 7.5% closed at $1.02, with 15,440 shares, Proven Investments jumped 74 cents to close at $5.89, with 14,939 units, changing hands. Trading in the foreign exchange on Thursday continued with heavy selling off US dollars by dealers and pushing the selling rate for the US dollar below $126.

Trading in the foreign exchange on Thursday continued with heavy selling off US dollars by dealers and pushing the selling rate for the US dollar below $126.  Actual US dollar purchases by dealers amounted to US$190.8 million down from US$210 million in the prior week and they sold US$214.92 million compared to US$214.95 million.

Actual US dollar purchases by dealers amounted to US$190.8 million down from US$210 million in the prior week and they sold US$214.92 million compared to US$214.95 million.

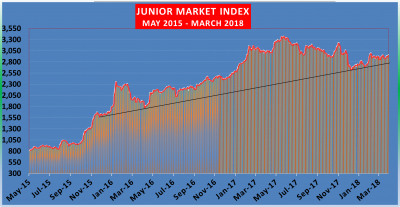

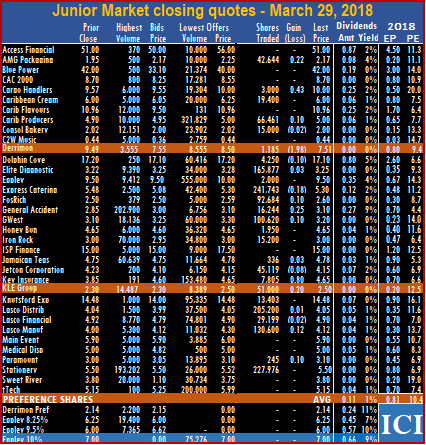

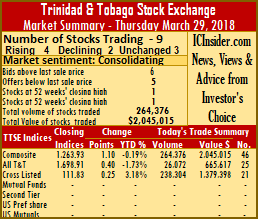

The Junior Market made further gain at the on Thursday with an advanced by 29.83 points to close at 2,958.51 as advancing stocks outnumbered decliners nearly 3 to 1.

The Junior Market made further gain at the on Thursday with an advanced by 29.83 points to close at 2,958.51 as advancing stocks outnumbered decliners nearly 3 to 1.  February closed with an average of 338,697 units at an average value of $1,495,774 for each security traded.

February closed with an average of 338,697 units at an average value of $1,495,774 for each security traded. Express Catering traded at an all-time intraday high of $6 but ended with a loss of 18 cents at $5.30, with 241,743 shares, FosRich Group finished trading 10 cents higher at $2.60, with 92,684 shares, General Accident closed 25 cents higher at $3.10, with 16,244 stock units, GWest Corporation ended 10 cents higher at $3.20, with 100,620 units. Honey Bun concluded trading at $4.65, with 1,950 shares, Iron Rock finished at $3, with 15,200 shares, Jamaican Teas ended trading 3 cents higher at $4.78, with 336 stock units, Jetcon Corporation traded with a loss of 8 cents at $4.15, with 45,119 units. Key Insurance finished trading 80 cents higher at $4.65, with 7,805 shares, KLE Group closed 20 cents higher at $2.50, with 51,000 shares, Knutsford Express ended at $14.48, with 13,403 shares, Lasco Distributors concluded trading 1 cent higher at $4.05, with 205,200 stock units. Lasco Financial finished with a loss of 2 cents at $4.90, with 29,199 units, Lasco Manufacturing settled 12 cents higher at $4.12, with 130,600 shares, Paramount Trading rose 10 cents to end at $3.10, with 245 stock units and Stationery and Office closed at $5.50, with 227,976 units changing hands.

Express Catering traded at an all-time intraday high of $6 but ended with a loss of 18 cents at $5.30, with 241,743 shares, FosRich Group finished trading 10 cents higher at $2.60, with 92,684 shares, General Accident closed 25 cents higher at $3.10, with 16,244 stock units, GWest Corporation ended 10 cents higher at $3.20, with 100,620 units. Honey Bun concluded trading at $4.65, with 1,950 shares, Iron Rock finished at $3, with 15,200 shares, Jamaican Teas ended trading 3 cents higher at $4.78, with 336 stock units, Jetcon Corporation traded with a loss of 8 cents at $4.15, with 45,119 units. Key Insurance finished trading 80 cents higher at $4.65, with 7,805 shares, KLE Group closed 20 cents higher at $2.50, with 51,000 shares, Knutsford Express ended at $14.48, with 13,403 shares, Lasco Distributors concluded trading 1 cent higher at $4.05, with 205,200 stock units. Lasco Financial finished with a loss of 2 cents at $4.90, with 29,199 units, Lasco Manufacturing settled 12 cents higher at $4.12, with 130,600 shares, Paramount Trading rose 10 cents to end at $3.10, with 245 stock units and Stationery and Office closed at $5.50, with 227,976 units changing hands.

Gains| First Caribbean International Bank rose 15 cents and settled at a 52 weeks’ high $9.50, after exchanging 123,125 shares. National Enterprises closed with a gain of 4 cents and completed trading at $9.79, with a mere 30 units,

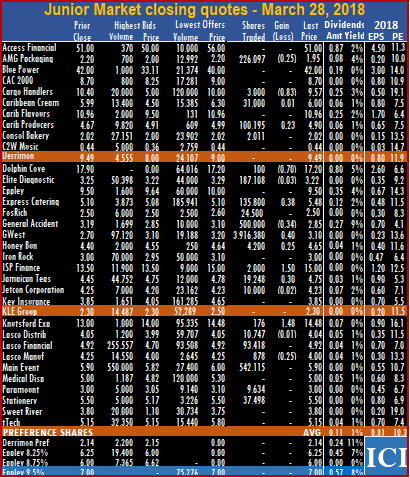

Gains| First Caribbean International Bank rose 15 cents and settled at a 52 weeks’ high $9.50, after exchanging 123,125 shares. National Enterprises closed with a gain of 4 cents and completed trading at $9.79, with a mere 30 units,  The Junior Market Index recovered most of the decline it suffered on Tuesday as it advanced by 23.72 points to close at 2,928.68 on Wednesday.

The Junior Market Index recovered most of the decline it suffered on Tuesday as it advanced by 23.72 points to close at 2,928.68 on Wednesday.  February closed with an average of 338,697 units at an average value of $1,495,774 for each security traded.

February closed with an average of 338,697 units at an average value of $1,495,774 for each security traded. General Accident closed with a loss of 34 cents at $2.85, with 500,000 stock units, GWest Corporation ended 40 cents higher at $3.10, with 3,916,380 units, Honey Bun concluded trading 25 cents higher at $4.65, with 4,200 shares,

General Accident closed with a loss of 34 cents at $2.85, with 500,000 stock units, GWest Corporation ended 40 cents higher at $3.10, with 3,916,380 units, Honey Bun concluded trading 25 cents higher at $4.65, with 4,200 shares,