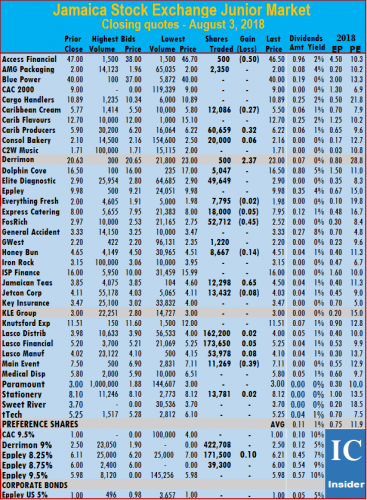

Unilever Caribbean crash $2.20 to sit at $27 just above the low of $26.75 reached in July, which is just above the price back in early July 2011.

Unilever Caribbean crash $2.20 to sit at $27 just above the low of $26.75 reached in July, which is just above the price back in early July 2011.

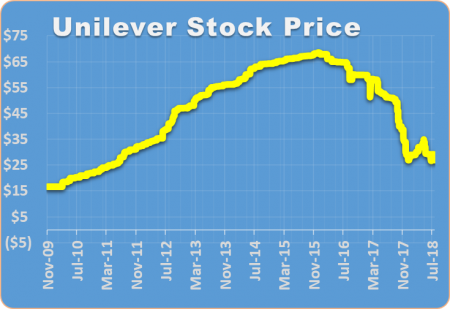

Trading on Trinidad & Tobago Stock Exchange on Monday was more moderate than on Friday with just 148,531 shares valued at $1,117,407 changing hands, compared to 271,085 units valued at $2,133,526, on Friday.

Market activity ended with 12 securities trading against 10 on Friday, with 4 advancing, 6 declining and 3 remaining unchanged. At the close the Composite Index declined 1.42 points on Monday to 1,233.08, the All T&T Index fell 0.83 points to 1,718.01 and the Cross Listed Index slipped 0.28 points to close at 100.54.

IC bid-offer Indicator| At the close of trading, the Investor’s Choice bid-offer indicator reading shows market sentiment with 3 stocks ending with higher bids than the last selling prices and 6 with lower offers.

Gains| Clico Investments closed with an increase of 3 cents at $20, with 2,992 stock units changing hands, One Caribbean Media rose 1 cent and concluded trading at $12.36, after exchanging 410 shares, Republic Financial Holdings finished 5 cents higher and concluded trading at a 562 weeks’ high of $102.88, after exchanging 145 shares and  Trinidad & Tobago NGL gained 14 cents and settled at $29.74, after exchanging 3,921 shares.

Trinidad & Tobago NGL gained 14 cents and settled at $29.74, after exchanging 3,921 shares.

Losses| First Caribbean International Bank lost 1 cent and completed trading at $8.49, with 114 units, JMMB Group ended trading 5 cents lower at $1.75, after exchanging 100,412 shares and Scotiabank concluded trading with a loss of 1 cent and ended at $65.01, with 3,522 units changing hands.

Firm Trades| First Citizens settled at $35.01, after exchanging 8,364 shares, National Flour completed trading at $1.79, with 137 units and Sagicor Financial ended at $7.50, with 27,732 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place.

dollars in the fourth quarter compared to nearly $11 million in 2017 after gross profit rose 29 percent or $28 million.

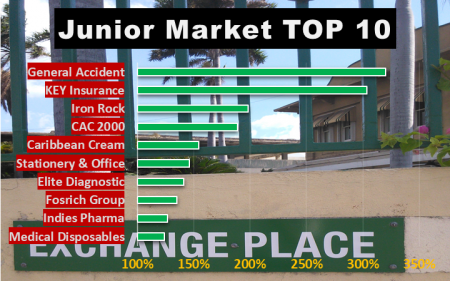

dollars in the fourth quarter compared to nearly $11 million in 2017 after gross profit rose 29 percent or $28 million.  stocks, compared to a market average of 13, a good indicator of the level of undervaluation of these stocks.

stocks, compared to a market average of 13, a good indicator of the level of undervaluation of these stocks.

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Inventories fell to $421 million from $544 million at the end of March as a direct result of the increase in business opportunities, but receivables remained over $300 million at $318 million, a bit on the high side and trade payables fell to $292 million. Borrowed funds stood at $331 million. Shareholders’ equity rose $19 million to $692 million.

Inventories fell to $421 million from $544 million at the end of March as a direct result of the increase in business opportunities, but receivables remained over $300 million at $318 million, a bit on the high side and trade payables fell to $292 million. Borrowed funds stood at $331 million. Shareholders’ equity rose $19 million to $692 million. Liquidity remains high, in the Jamaican financial market with investors driving the average to 1.74 percent on Bank of Jamaica (BOJ) 30 days certificate of deposit earlier this week, as demand of $24 billion chased $8.5 billion on offer.

Liquidity remains high, in the Jamaican financial market with investors driving the average to 1.74 percent on Bank of Jamaica (BOJ) 30 days certificate of deposit earlier this week, as demand of $24 billion chased $8.5 billion on offer.

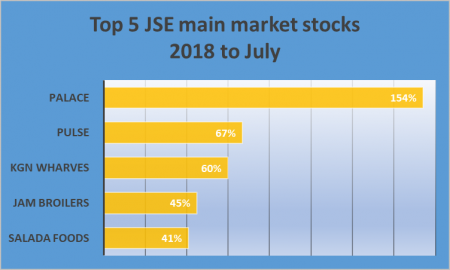

The big winners for the year to July are,

The big winners for the year to July are,  The big losers in the main market are,

The big losers in the main market are,

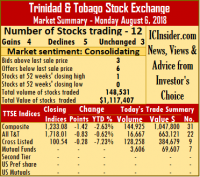

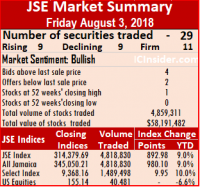

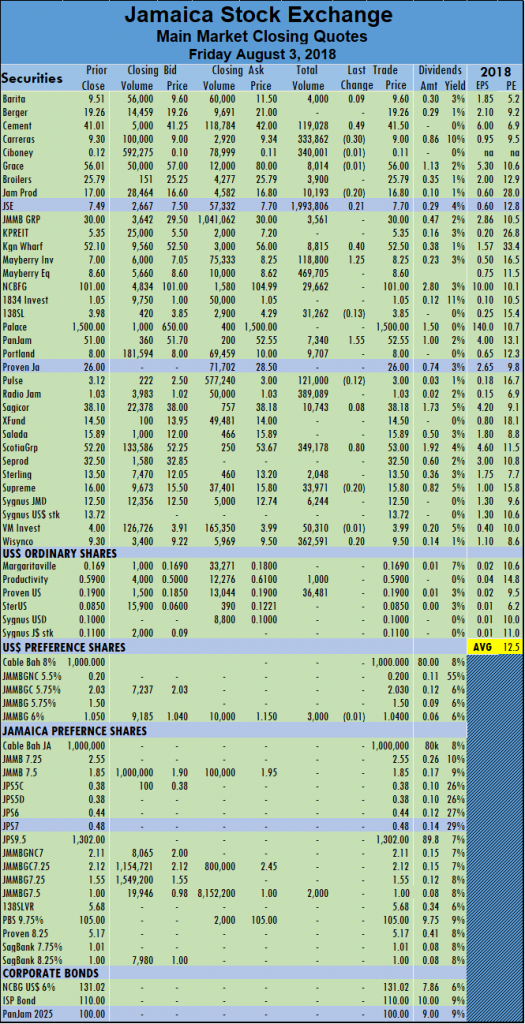

Market activities resulted in 29 securities trading including 3 in the US dollar market compared to 31 securities trading on Thursday. At the end of trading, the prices of 9 stocks rose, 9 declined and 11 traded unchanged.

Market activities resulted in 29 securities trading including 3 in the US dollar market compared to 31 securities trading on Thursday. At the end of trading, the prices of 9 stocks rose, 9 declined and 11 traded unchanged. Trading in the US dollar market closed with 40,481 units valued at US$10,641 as JMMB Group 6 percent preference share completed trading of 3,000 stock units and fell 1 cents to end at $1.04, Productive Business Solution ended trading 1,000 shares to close at 59 US cents and Proven Investments closed at 19 US cents trading 36,481 shares. The JSE USD Equities Index close unchanged at 155.14.

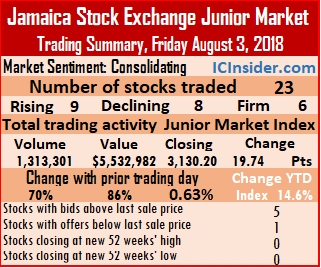

Trading in the US dollar market closed with 40,481 units valued at US$10,641 as JMMB Group 6 percent preference share completed trading of 3,000 stock units and fell 1 cents to end at $1.04, Productive Business Solution ended trading 1,000 shares to close at 59 US cents and Proven Investments closed at 19 US cents trading 36,481 shares. The JSE USD Equities Index close unchanged at 155.14. The Junior Market Index climbed higher by 19.74 points to close at 3,130.20 on Friday as 23 securities changed hands, compared to 19 on Thursday, with 9 advancing, 8 falling and 6 remaining unchanged.

The Junior Market Index climbed higher by 19.74 points to close at 3,130.20 on Friday as 23 securities changed hands, compared to 19 on Thursday, with 9 advancing, 8 falling and 6 remaining unchanged.  The average volume and value for the month to date amounts to 49,641 units valued at $202,520. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

The average volume and value for the month to date amounts to 49,641 units valued at $202,520. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.