Indies dominated trading on Tuesday.

Trading volume jumped sharply on the Junior Market, Indies Pharma traded 4,712,727 units or 51.38 percent of trading, followed by Caribbean Producers with 1,769,989 units and accounting for 19.30 percent of the volume traded and Lasco Financial Services with 1,638,268 units representing 17.86 percent of the day’s trade.

Blue Power 10 for 1 stock split took place today, but most investors were unaware as there was attempts to trade the stock at the old price of $47 which falsely push the index up by 557 points which was corrected at the close to reflect a decline.

At the close of the trading session the market index fell 34.25 points to close at 3,205.09, with 28 securities changing hands, down from 24 securities changing hands on Monday.

IC bid-offer Indicator|At the end of trading, the Investor’s Choice bid-offer indicator reading had 8 stocks ending with bids higher than their last selling prices, 3 closed with lower offers.

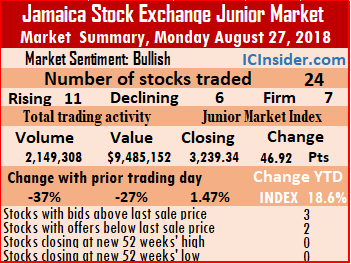

The market closed with the prices of 6 advancing, 6 declining and 16 remaining unchanged and resulting in an exchange of 9,172,835 units valued at $44,109,271, compared to 2,149,308 units valued at $9,485,152 on Monday.

Trading closed with an average of 327,601 units for an average of $1,575,331 in contrast to 89,555 units for an average of $395,215 on Monday.  The average volume and value for the month to date amounts to 273,263 units at $1,335,149, compared to 269,588 units at $1,318,905 on the previous trading day. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

The average volume and value for the month to date amounts to 273,263 units at $1,335,149, compared to 269,588 units at $1,318,905 on the previous trading day. Trading in July, averaged 154,060 units valued at $655,146 for each security traded.

At the close of trading, AMG Packaging ended at $1.95, trading 2,400 stock units, CAC 2000 finished at $9, exchanging 10,797 shares, Cargo Handlers settled with 1,000 shares trading and rose 20 cents to end at $11.20, Caribbean Flavours traded 513,596 stock units and gained $2 to close at a 52 weeks’ high of $18, Caribbean Producers finished trading 1,769,989 units at $6.90. Consolidated Bakeries closed with a loss of 13 cents at $2.37, with 20,388 shares changing hands, Derrimon Trading ended at $25, with 1,400 shares, Dolphin Cove concluded trading of 5,885 shares at $17, Elite Diagnostic finished at $3.10, exchanging 24,500 stock units. Eppley settled at $10.18, with 500 units traded, Everything Fresh fell 1 cent in trading 135,831 shares and ended at $2.20, Express Catering ended trading 49,383 shares at $8, FosRich Group traded 5 cents higher at $3, while exchanging 51,984 shares, General Accident finished trading of 38,206 shares at $3.85. GWest Corporation closed 8 cents higher at $2.18, with 30,000 stock units, Honey Bun ended at $4.50, with juts 340 units trading, Indies Pharma dominated trading with 4,712,727 shares to end unchanged at $2.50,  Iron Rock concluded trading of 5,000 shares with a loss of 20 cents at $3.30, Jamaican Teas settled at $3.95, with 5,000 shares. Jetcon Corporation ended trading 84,527 stock units with a loss of 5 cents to end at $4, Knutsford Express closed with a loss of $1 at $11.50, with 5,648 shares changing hands, Lasco Distributors ended with a loss of 1 cent at $3.90, with 7,868 shares, Lasco Financial concluded trading 1,638,268 stock units at $5.60. Lasco Manufacturing finished at $3.86, with 3,935 units, Main Event settled at $7, in trading 30,439 shares, Stationery and Office finished trading 21,349 stock units and gained 20 cents to close at $8.85, and Sweet River closed 16 cents higher at $3.86, with 875 units. In the junior market preference segment, Derrimon Trading ended 2 cents higher at a 52 weeks’ high of $2.52, with 1,000 stock units changing hands.

Iron Rock concluded trading of 5,000 shares with a loss of 20 cents at $3.30, Jamaican Teas settled at $3.95, with 5,000 shares. Jetcon Corporation ended trading 84,527 stock units with a loss of 5 cents to end at $4, Knutsford Express closed with a loss of $1 at $11.50, with 5,648 shares changing hands, Lasco Distributors ended with a loss of 1 cent at $3.90, with 7,868 shares, Lasco Financial concluded trading 1,638,268 stock units at $5.60. Lasco Manufacturing finished at $3.86, with 3,935 units, Main Event settled at $7, in trading 30,439 shares, Stationery and Office finished trading 21,349 stock units and gained 20 cents to close at $8.85, and Sweet River closed 16 cents higher at $3.86, with 875 units. In the junior market preference segment, Derrimon Trading ended 2 cents higher at a 52 weeks’ high of $2.52, with 1,000 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place.

The Trinidad & Tobago Stock Exchange ended trading on Tuesday with 13 securities changing hands against 9 on Monday, none advanced, 2 declined and 11 remained unchanged.

The Trinidad & Tobago Stock Exchange ended trading on Tuesday with 13 securities changing hands against 9 on Monday, none advanced, 2 declined and 11 remained unchanged.  Clico Investments ended at $20, with 2,037 stock units changing hands, First Citizens settled at $34.91, after exchanging 899 shares, Guardian Holdings completed trading at $17, with 146 units, JMMB Group traded down to $1.70 but concluded trading at $1.78, after exchanging 28,516 shares, Massy Holdings concluded at $47, after exchanging 2,085 shares, Republic Financial Holdings concluded at $103.50, after exchanging 1,580 shares, Sagicor Financial ended at $7.75, with 546 stock units changing hands, Scotiabank completed trading at $65, with 325 units, Trinidad & Tobago NGL settled at $30, after exchanging 3,031 shares and Trinidad Cement concluded at $2.90, after exchanging 2,000 shares

Clico Investments ended at $20, with 2,037 stock units changing hands, First Citizens settled at $34.91, after exchanging 899 shares, Guardian Holdings completed trading at $17, with 146 units, JMMB Group traded down to $1.70 but concluded trading at $1.78, after exchanging 28,516 shares, Massy Holdings concluded at $47, after exchanging 2,085 shares, Republic Financial Holdings concluded at $103.50, after exchanging 1,580 shares, Sagicor Financial ended at $7.75, with 546 stock units changing hands, Scotiabank completed trading at $65, with 325 units, Trinidad & Tobago NGL settled at $30, after exchanging 3,031 shares and Trinidad Cement concluded at $2.90, after exchanging 2,000 shares The stock worth watching this week is

The stock worth watching this week is

The Jamaica Stock Exchange surged sharply in early trading on Tuesday, with the

The Jamaica Stock Exchange surged sharply in early trading on Tuesday, with the  Bank of Jamaica (BOJ) scheduled

Bank of Jamaica (BOJ) scheduled

Temperature on the Jamaica Stock Exchange was far more subdued in trading on Monday with both volume and value pulling sharply from Friday’s levels and leaving the two major indices down at the close.

Temperature on the Jamaica Stock Exchange was far more subdued in trading on Monday with both volume and value pulling sharply from Friday’s levels and leaving the two major indices down at the close.  At the end of trading, the prices of 9 stocks rose, 12 declined and 4 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 5 cents to close at an all-time low of $4.95.

At the end of trading, the prices of 9 stocks rose, 12 declined and 4 closed trading unchanged. Stanley Motta closed with 2,211 units changing hands after falling 5 cents to close at an all-time low of $4.95. Jamaica Producers rose 70 cents and finished trading 43,354 units at $18, Mayberry Investments fell 95 cents to settle at $7.05, in exchanging 6,993 shares. NCB Financial Group fell $1 and ended trading 12,713 shares at $109, Sagicor Group gained 40 cents and settled at $38.05, trading 6,713 stock units. Sagicor Real Estate Fund climbed $1 and closed at $12 exchanging 23,171 shares, Salada Foods gained 50 cents and ended trading 19,300 stock units at $18, Scotia Group traded 101,372 units at and closed $52.50, after adding 50 cents and Supreme Ventures lost 50 cents and ended at $15, in the trading of 17,810 shares.

Jamaica Producers rose 70 cents and finished trading 43,354 units at $18, Mayberry Investments fell 95 cents to settle at $7.05, in exchanging 6,993 shares. NCB Financial Group fell $1 and ended trading 12,713 shares at $109, Sagicor Group gained 40 cents and settled at $38.05, trading 6,713 stock units. Sagicor Real Estate Fund climbed $1 and closed at $12 exchanging 23,171 shares, Salada Foods gained 50 cents and ended trading 19,300 stock units at $18, Scotia Group traded 101,372 units at and closed $52.50, after adding 50 cents and Supreme Ventures lost 50 cents and ended at $15, in the trading of 17,810 shares. The Junior Market, put in a strong showing in Monday’s trading session and closed with the market index jumping 46.92 points to close at 3,239.34, with 24 securities changing hands, down from 26 securities changing hands on Friday.

The Junior Market, put in a strong showing in Monday’s trading session and closed with the market index jumping 46.92 points to close at 3,239.34, with 24 securities changing hands, down from 26 securities changing hands on Friday.  Access Financial closed trading of 19,338 shares at $45, AMG Packaging rose 5 cents to close at $1.95, trading 3,424 stock units, Blue Power concluded trading of 9,672 units at $47, Caribbean Flavours traded 710 stock units at $16, Caribbean Producers finished trading of 60,350 units 11 cents higher to $6.90. Derrimon Trading ended $4 higher at $25, exchanging 18,909 shares, Dolphin Cove concluded trading at $17, with 1,100 shares being exchanged, Elite Diagnostic gained 10 cents to end at $3.10, with 26,004 stock units changing hands, Eppley settled at $10.18, trading 7,800 units. Everything Fresh gained just 1 cent in trading 65,426 shares and ended at $2.21, Express Catering ended trading 22,033 shares and lost 30 cents to end at $8, FosRich Group traded 50,000 shares with a loss of 5 cents at $2.95, General Accident finished trading 185,258 shares and rose 5 cents to $3.85, GWest Corporation closed 10 cents higher at $2.10, in exchanging 30,756 stock units.

Access Financial closed trading of 19,338 shares at $45, AMG Packaging rose 5 cents to close at $1.95, trading 3,424 stock units, Blue Power concluded trading of 9,672 units at $47, Caribbean Flavours traded 710 stock units at $16, Caribbean Producers finished trading of 60,350 units 11 cents higher to $6.90. Derrimon Trading ended $4 higher at $25, exchanging 18,909 shares, Dolphin Cove concluded trading at $17, with 1,100 shares being exchanged, Elite Diagnostic gained 10 cents to end at $3.10, with 26,004 stock units changing hands, Eppley settled at $10.18, trading 7,800 units. Everything Fresh gained just 1 cent in trading 65,426 shares and ended at $2.21, Express Catering ended trading 22,033 shares and lost 30 cents to end at $8, FosRich Group traded 50,000 shares with a loss of 5 cents at $2.95, General Accident finished trading 185,258 shares and rose 5 cents to $3.85, GWest Corporation closed 10 cents higher at $2.10, in exchanging 30,756 stock units.  Indies Pharma pulled back 4 cents in trading 539,221 shares to end at $2.50, Jamaican Teas settled with a loss of 30 cents at $3.95, trading 9,000 shares, Jetcon Corporation rose 4 cents to $4.05, in trading 42,069 stock units, KLE Group finished trading of 6,200 shares at $3, Lasco Distributors ended 6 cents higher at $3.91, with 12,000 shares changing hands. Lasco Financial concluded trading of 4,783 stock units and lost 30 cents to end at $5.60, Lasco Manufacturing finished 1 cent higher at $3.86, with 1,013,663 units changing hands, Main Event settled at $7, exchanging 9,692 shares, Stationery and Office finished trading 2,000 stock units and rose 5 cents to $8.65 and tTech ended with a loss of 43 cents at $5.07, with 9,900 shares changing hands.

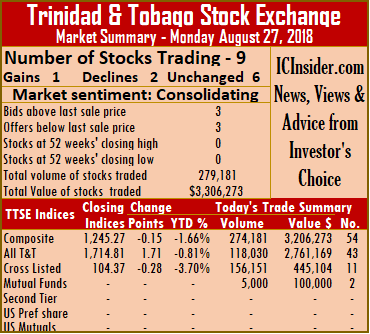

Indies Pharma pulled back 4 cents in trading 539,221 shares to end at $2.50, Jamaican Teas settled with a loss of 30 cents at $3.95, trading 9,000 shares, Jetcon Corporation rose 4 cents to $4.05, in trading 42,069 stock units, KLE Group finished trading of 6,200 shares at $3, Lasco Distributors ended 6 cents higher at $3.91, with 12,000 shares changing hands. Lasco Financial concluded trading of 4,783 stock units and lost 30 cents to end at $5.60, Lasco Manufacturing finished 1 cent higher at $3.86, with 1,013,663 units changing hands, Main Event settled at $7, exchanging 9,692 shares, Stationery and Office finished trading 2,000 stock units and rose 5 cents to $8.65 and tTech ended with a loss of 43 cents at $5.07, with 9,900 shares changing hands. The Trinidad & Tobago Stock Exchange ended trading on Monday with 9 securities changing hands against 14 on Friday, 1 advanced, 2 declined and 6 remained unchanged.

The Trinidad & Tobago Stock Exchange ended trading on Monday with 9 securities changing hands against 14 on Friday, 1 advanced, 2 declined and 6 remained unchanged.  hands and Trinidad & Tobago NGL shed 1 cent and settled at $30, after exchanging 38,368 shares.

hands and Trinidad & Tobago NGL shed 1 cent and settled at $30, after exchanging 38,368 shares. The bullishness continued on Jamaica Stock Exchange, driving the main market to more record highs and hitting more than 352,000 points on Friday, while the Junior Market traded at a 15 months’ high.

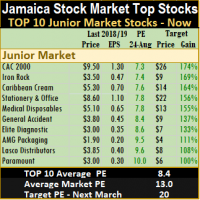

The bullishness continued on Jamaica Stock Exchange, driving the main market to more record highs and hitting more than 352,000 points on Friday, while the Junior Market traded at a 15 months’ high.  General Accident has been at the top of the Junior Market list for a long time, enjoyed a bounce in the price to $3.80 by the end of the week, helped by half year results that showed profit rising from $8 million in 2017 to $95 million in the half year, with the quarter up from a loss of $9 million to a profit of $66 after tax. IC Insider.com also down graded earnings for the full year to 45 cents per share and the stock now sits at 6th spot in the list. The PE is just 8.4 and will go higher.

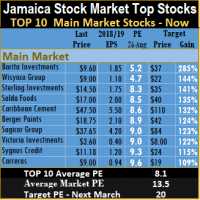

General Accident has been at the top of the Junior Market list for a long time, enjoyed a bounce in the price to $3.80 by the end of the week, helped by half year results that showed profit rising from $8 million in 2017 to $95 million in the half year, with the quarter up from a loss of $9 million to a profit of $66 after tax. IC Insider.com also down graded earnings for the full year to 45 cents per share and the stock now sits at 6th spot in the list. The PE is just 8.4 and will go higher. Work done by IC Insider.com suggests that the PE ratio is likely to end 2018 around 16 or 17 times earnings, as investors continue to gradually upgrade the multiple they are prepared to pay for stocks, which would lift prices sharply over the next several months from current levels. In addition, the latest Treasury bill offer saw rates dropping to 1.7 percent on the 91 days instrument and 1.88 percent on the 182 days instrument. These rates suggest more funds will be going into stocks as liquidity remains high.

Work done by IC Insider.com suggests that the PE ratio is likely to end 2018 around 16 or 17 times earnings, as investors continue to gradually upgrade the multiple they are prepared to pay for stocks, which would lift prices sharply over the next several months from current levels. In addition, the latest Treasury bill offer saw rates dropping to 1.7 percent on the 91 days instrument and 1.88 percent on the 182 days instrument. These rates suggest more funds will be going into stocks as liquidity remains high.

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.

Based on an assumed PE for each, the likely gains are determined and then ranked, with the stocks with the highest potential gains ranked first followed by the rest, in descending order. Potential values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis based on new information received that can result in changes in and out of the list as well.