Subscribers for shares in the public offer of 74,062,500 Ordinary Shares in iCreate received a high percentage of the amount applied for, except for applications with more than 400,000 units.

Subscribers for shares in the public offer of 74,062,500 Ordinary Shares in iCreate received a high percentage of the amount applied for, except for applications with more than 400,000 units.

According to Sagicor Investments, the lead broker for the issue, all the applications received, the first 400,000 units in full with those with balances in excess of 400,000 units for the General Public Pool was allocated approximately 1.32 percent of the excess.

This is not great news for many of the investors in the issue as they could see a fall in the price of the stock as there seem to be inadequate demand for the stock at the issue price of $1.01 before it moves higher.

The stock is scheduled to be listed on the Junior Market of the Jamaica Stock Exchange.

Weak demand to affect ICreate stock

TTSE slips back on Wednesday

Market activity on the Trinidad & Tobago Stock Exchange ended on Wednesday with 14 securities trading against 12 on Tuesday, with 5 advancing, 7 declining and 2 remaining unchanged.

Market activity on the Trinidad & Tobago Stock Exchange ended on Wednesday with 14 securities trading against 12 on Tuesday, with 5 advancing, 7 declining and 2 remaining unchanged.

At close of the market, the Composite Index declined by 2.12 points to close at 1,304.95. The All T&T Index lost 0.36 points to 1,707.09, while the Cross Listed Index fell 0.54 points to close at 121.97.

Trading ended with 619,436 shares at a value of $6,956,090, compared to 138,119 shares on Tuesday valued at $2,094,012.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended at 5 stocks with bids higher than their last selling prices and 1 with a lower offer.

Stocks closing with gains| Clico Investments added 2 cents and ended at $20.18, with 70,376 stock units changing hands, First Citizens increased 10 cents to settle at $34, after exchanging 3,105 shares, Massy Holdings rose 25 cents to close at a 52 weeks’ high of $47.75, after exchanging 1,112 shares. Prestige Holdings closed with a gain of 5 cents in trading of 2,730 units at $7.40 and West Indian Tobacco gained 2 cents and ended at $95.42, with 6 stock units changing hands.

Stocks closing with losses| Agostini’s fell 5 cents to $23.15, after exchanging 1,732 shares, Angostura Holdings fell 1 cent and ended at $16.04, with 200 stock units changing hands, Ansa Mcal shed 20 cents and completed trading of 2,027 units at $55. JMMB Group lost 4 cents and ended at $1.75, after exchanging 51,813 shares, National Flour fell by 1 cent and completed trading of 642 units at $1.64, NCB Financial Group lost 5 cents and settled at $8.40, after exchanging 472,460 shares and Republic Financial Holdings concluded trading with a loss of 3 cents at $107.52, after exchanging 9,725 shares.

Stocks closing firm| Guardian Holdings completed trading of 230 units at $18 and Trinidad & Tobago NGL completed trading with 3,278 units at $29.20.

Prices of securities trading for the day are those at which the last trade took place.

TTSE index posts 2018 gains – Tuesday

All Trinidad and Tobago Stock Exchange index

Trading on the Trinidad & Tobago Stock Exchange landed the main market index into positive territory for the second time this year as the market ended on Tuesday trading in 12 securities against 12 on Monday, with 8 advancing, 1 declining and 3 remaining unchanged.

At close of the market, the Composite Index climbed 2.88 points to 1,307.07. The All T&T Index gained 3.18 points to 1,707.45, while the Cross Listed Index rose 0.35 points to close at 122.51.

Trading ended with 138,119 shares at a value of $2,094,012, compared to 65,772 shares on Monday valued at $1,823,304.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended at 3 stocks with bids lower than their last selling prices and 3 with lower offers.

Stocks closing with gains| Ansa Mcal increased 20 cents to close at $55.20, in trading 94 shares, Ansa Merchant Bank rose 50 cents to $38.50, after exchanging 134 shares, First Citizens closed with a gain of 5 cents at $33.90, in exchanging 1,152 shares, Massy Holdings gained 1 cent and ended at $47.50, after exchanging 3,188  shares, NCB Financial Group finished trading 7,050 shares and rose 5 cents to $8.45. Republic Financial Holdings closed with an increase of 3 cents and after exchanging 264 shares, to end at $107.55, Scotiabank rose 25 cents and completed trading at $63.90, with 23 stock units changing hands and Trinidad & Tobago NGL finished 6 cents higher to $29.20, with an exchange of 40,009 units.

shares, NCB Financial Group finished trading 7,050 shares and rose 5 cents to $8.45. Republic Financial Holdings closed with an increase of 3 cents and after exchanging 264 shares, to end at $107.55, Scotiabank rose 25 cents and completed trading at $63.90, with 23 stock units changing hands and Trinidad & Tobago NGL finished 6 cents higher to $29.20, with an exchange of 40,009 units.

Stocks closing with losses| Trinidad Cement concluded trading with a loss of 5 cents at $2.60, after exchanging 66,674 shares.

Stocks closing firm | Clico Investments completed trading at $20.16, with 16,869 stock units changing hands, Sagicor Financial ended at $9.02, after exchanging 1,507 shares and West Indian Tobacco completed trading of 1,155 stock units at $95.40.

Prices of securities trading for the day are those at which the last trade took place.

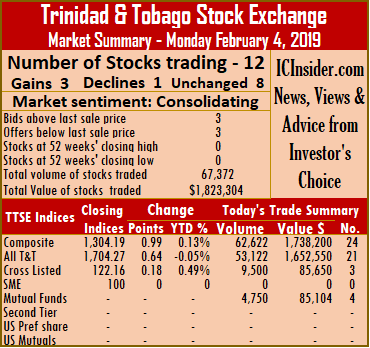

Trading falls on TTSE – Monday

Trading on the Trinidad & Tobago Stock Exchange dipped on Monday with volume and value of stocks trading down on Friday levels.

Trading on the Trinidad & Tobago Stock Exchange dipped on Monday with volume and value of stocks trading down on Friday levels.

The market closed with 12 securities changing hands, compared to 15 on Friday, with just 67,372 shares at a value of $1,823,304 changing hands, compared to 971,051 units at a value of $11,872,964 on Friday.

Market activity closed, with stocks 3 advancing, 1 declining and 8 remaining unchanged. At the close, the Composite Index rose 0.99 points on Monday to 1,304.19. The All T&T Index added 0.64 points to end at 1,704.27, while the Cross Listed Index rose 0.18 points to close at 122.16.

IC bid-offer Indicator| The Investor’s Choice bid-offer ended at 3 stocks with bids lower than their last selling prices and 3 with lower offers.

Stocks closing with gains| First Citizens finished 3 cents higher to settle at $33.85, after exchanging 2,623 shares, Massy Holdings concluded trading of 1,000 shares and rose 29 cents to close at $47.49 and Sagicor Financial gained 21 cents to $9.02, after trading 9,500 shares.

Stocks closing with losses| Clico Investments closed with a loss of 1 cent to end at $20.16, with 3,150 stock units changing hands.

Stocks closing firm | Agostini’s concluded trading of 100 shares at $23.20, Angostura Holdings ended at $16.05, with 11,464 stock units changing hands, Calypso Macro Index Fund ended trading of 1,600 stock units at $13.50, Guardian Holdings completed trading at $18, with 8,899 units. National Enterprises ended at $8, with 15,000 stock units changing hands, Prestige Holdings completed trading of 1,000 units at $7.35, Trinidad & Tobago NGL traded 3,036 units at $29.14 and West Indian Tobacco closed at $95.40, with 10,000 stock units changing hands.

Prices of securities trading for the day are those at which the last trade took place.

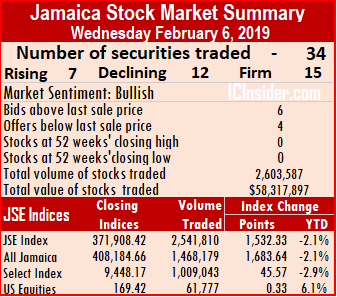

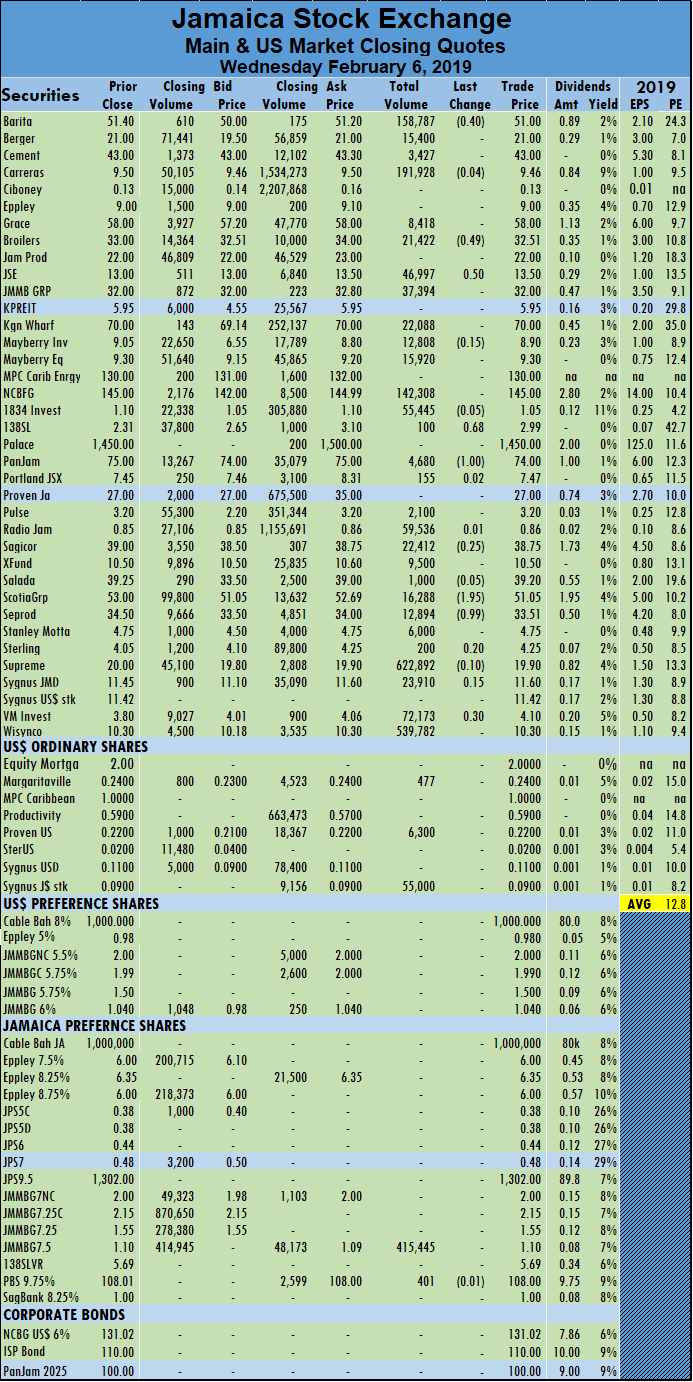

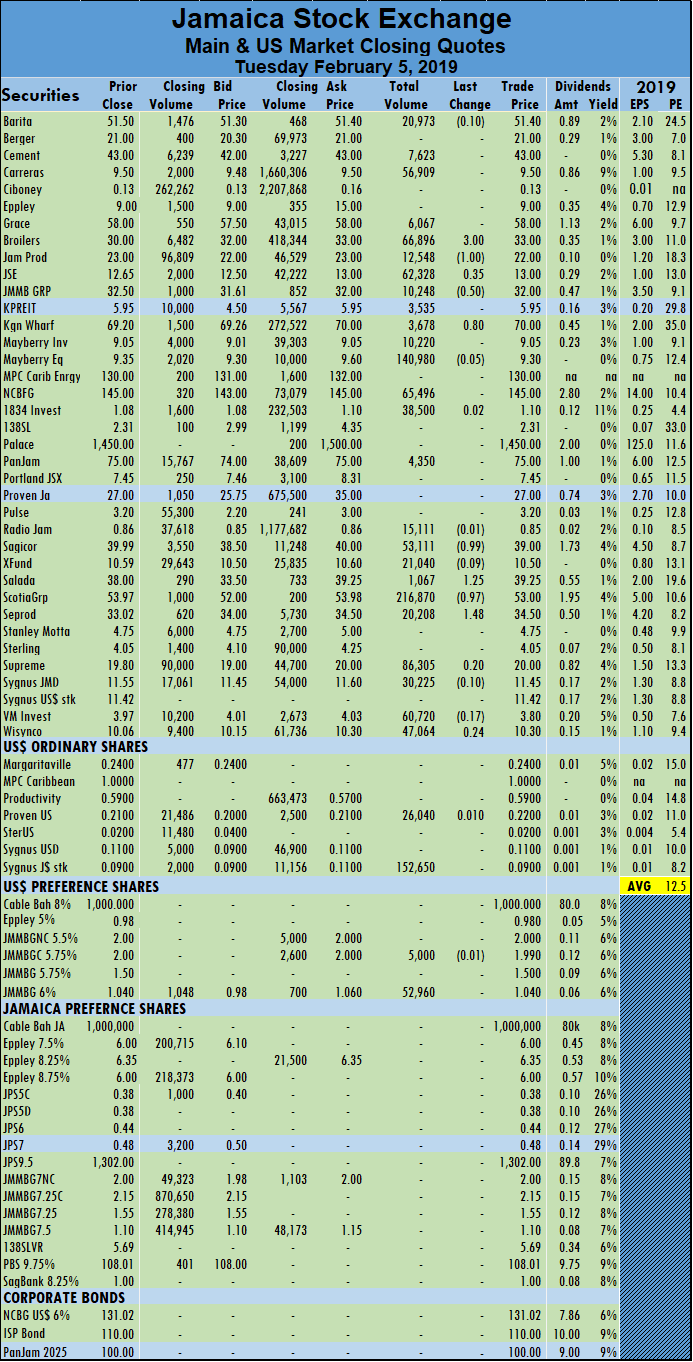

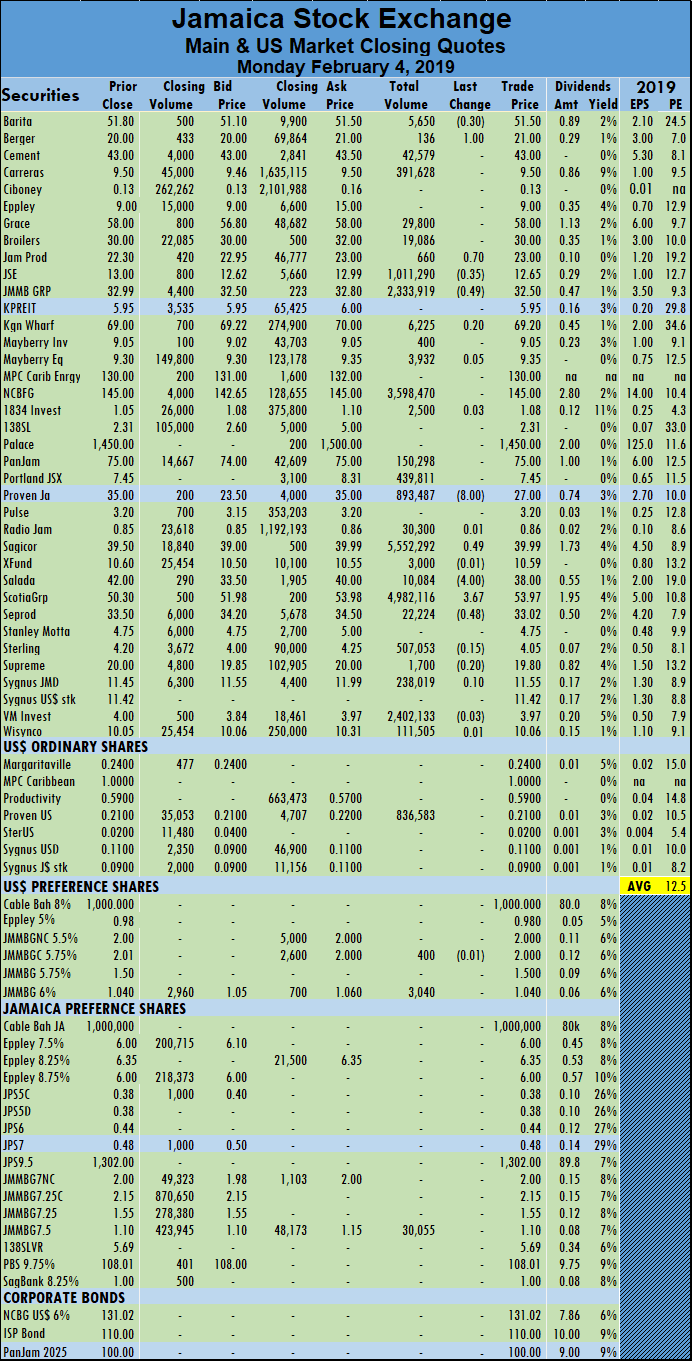

Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with JSE All Jamaican Composite Index climbing 1,683.64 points to 408,184.66 and the JSE Index advancing by 1,532.33 points to close at 371,908.42.

Trading on the main market of the Jamaica Stock Exchange ended on Wednesday with JSE All Jamaican Composite Index climbing 1,683.64 points to 408,184.66 and the JSE Index advancing by 1,532.33 points to close at 371,908.42. Wisynco Group with 539,782 shares and accounting for 21 percent of the total main market volume changing hands and JMMB Group 7.5% preference share with 415,445 stock units for 16 percent of the day’s volume.

Wisynco Group with 539,782 shares and accounting for 21 percent of the total main market volume changing hands and JMMB Group 7.5% preference share with 415,445 stock units for 16 percent of the day’s volume. 46,997 units changing hands with a rise of 50 cents to $13.50. Kingston Wharves gained 80 cents and settled at $70.00, with 3,678 units changing hands, 138 Student Living rose 68 cents to $2.99, in trading 100 units, PanJam Investment lost $1 to end at $74 with 4,680 units changing hands. Sagicor Group fell by 25 cents trading 22,412 stock units, to close at $38.75, Scotia Group lost $1.95 and finished trading of 16,288 shares at $51.05 and Seprod lost 99 cents to end at $33.51 with an exchange of 12,894 shares.

46,997 units changing hands with a rise of 50 cents to $13.50. Kingston Wharves gained 80 cents and settled at $70.00, with 3,678 units changing hands, 138 Student Living rose 68 cents to $2.99, in trading 100 units, PanJam Investment lost $1 to end at $74 with 4,680 units changing hands. Sagicor Group fell by 25 cents trading 22,412 stock units, to close at $38.75, Scotia Group lost $1.95 and finished trading of 16,288 shares at $51.05 and Seprod lost 99 cents to end at $33.51 with an exchange of 12,894 shares.

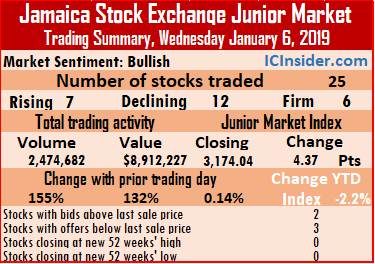

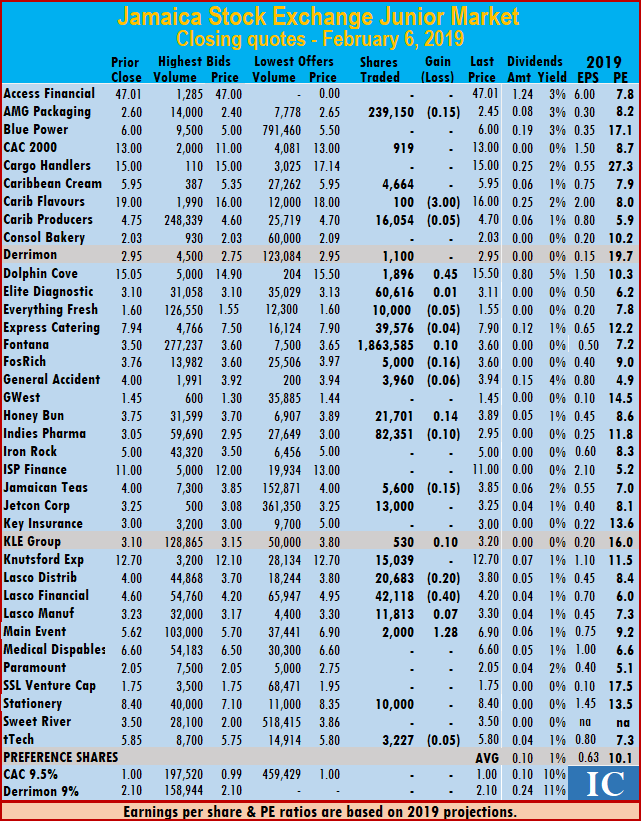

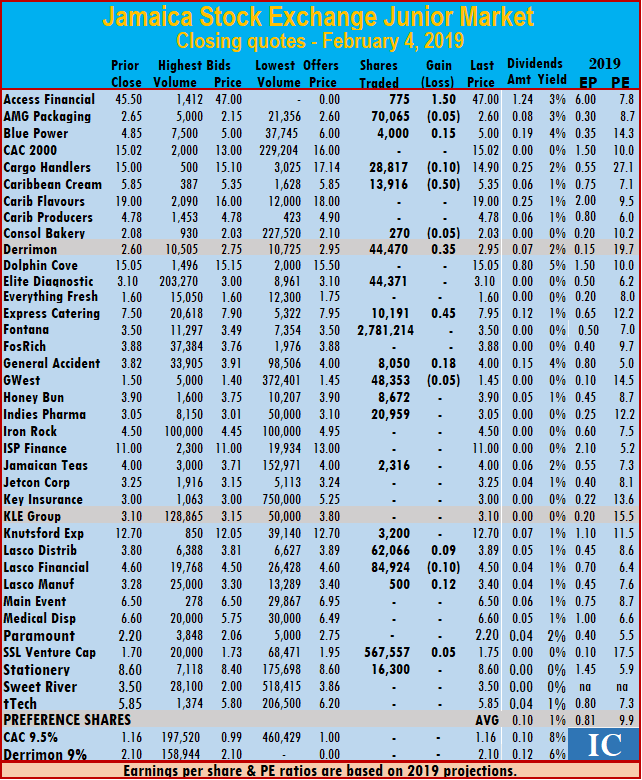

stock units trading, Honey Bun concluded trading of 21,701 shares, and closed 14 cents higher at $3.89, Indies Pharma ended trading at $2.95, with 82,351 units, Jamaican Teas closed trading with 5,600 stock units after declining 15 cents at $3.85. Jetcon Corporation closed at $3.25, with 13,000 units changing hands, KLE Group closed 10 cents higher at $3.20, after trading 530 shares, Knutsford Express ended at $12.70, with an exchange of 15,039 shares, Lasco Distributors lost 20 cents to close at $3.80, with 20,683 stock units changing hands. Lasco Financial finished with a loss of 40 cents at $4.20, with an exchange of 42,118 units, Lasco Manufacturing settled 7 cents higher at $3.30, in trading 11,813 shares, Main Event ended trading 2,000 shares, with a loss of 7 cents to close at $5.55, Stationery and Office ended at $8.40, trading 10,000 shares and tTech finished with a loss of 5 cents at $5.80, as 3,227 shares changed hands.

stock units trading, Honey Bun concluded trading of 21,701 shares, and closed 14 cents higher at $3.89, Indies Pharma ended trading at $2.95, with 82,351 units, Jamaican Teas closed trading with 5,600 stock units after declining 15 cents at $3.85. Jetcon Corporation closed at $3.25, with 13,000 units changing hands, KLE Group closed 10 cents higher at $3.20, after trading 530 shares, Knutsford Express ended at $12.70, with an exchange of 15,039 shares, Lasco Distributors lost 20 cents to close at $3.80, with 20,683 stock units changing hands. Lasco Financial finished with a loss of 40 cents at $4.20, with an exchange of 42,118 units, Lasco Manufacturing settled 7 cents higher at $3.30, in trading 11,813 shares, Main Event ended trading 2,000 shares, with a loss of 7 cents to close at $5.55, Stationery and Office ended at $8.40, trading 10,000 shares and tTech finished with a loss of 5 cents at $5.80, as 3,227 shares changed hands. The main market of the Jamaica Stock Exchange major indices roseat the close on Tuesday, but with sharply lower volume that dropped 95 percent from Monday’s levels.

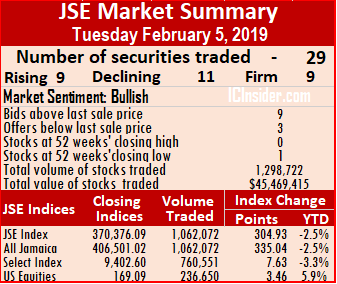

The main market of the Jamaica Stock Exchange major indices roseat the close on Tuesday, but with sharply lower volume that dropped 95 percent from Monday’s levels.

changing hands, Sagicor Group fell 99 cents trading 53,111 stock units, to close at $39, Salada Foods jumped $1.25 to $39.25 in trading 1,067 units. Scotia Group lost 97 cents and finished trading of 216,870 shares at $53 and Seprod rose $1.48 cents to end at $34.50 with an exchange of 20,208 shares.

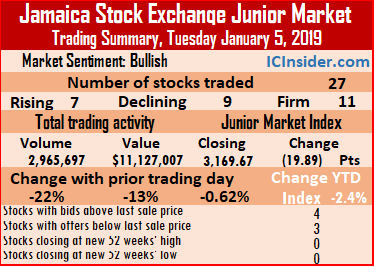

changing hands, Sagicor Group fell 99 cents trading 53,111 stock units, to close at $39, Salada Foods jumped $1.25 to $39.25 in trading 1,067 units. Scotia Group lost 97 cents and finished trading of 216,870 shares at $53 and Seprod rose $1.48 cents to end at $34.50 with an exchange of 20,208 shares. The Junior Market index of the Jamaica Stock Exchange dropped 19.89 points to 3,169.67 at the end of trading on Tuesday, as the prices of 7 securities rose, 9 declined and 11 remained unchanged.

The Junior Market index of the Jamaica Stock Exchange dropped 19.89 points to 3,169.67 at the end of trading on Tuesday, as the prices of 7 securities rose, 9 declined and 11 remained unchanged.

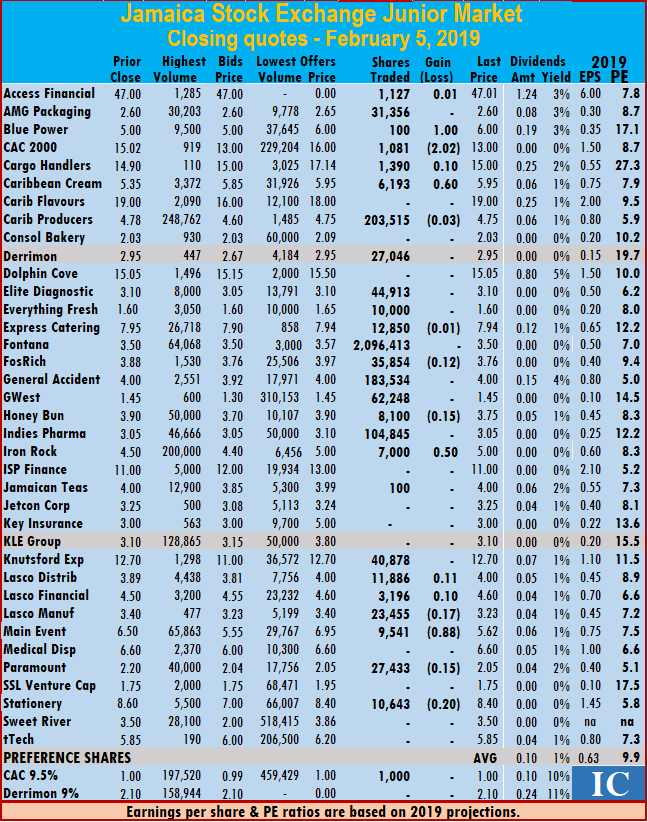

of 15 cents at $3.75, with an exchange of 8,100 stock units, Indies Pharma closed at $3.05 trading 104,845 shares. Iron Rock ended 50 cents higher at $5, with 7,000 units trading, Jamaican Teas exchanged 100 shares at $4, Knutsford Express finished trading of 40,878 shares at $12.70, Lasco Distributors closed 11 cents higher at $4, in trading 11,886 shares. Lasco Financial ended 10 cents higher at $4.60, with 3,196 shares traded, Lasco Manufacturing concluded trading of 23,455 stock units, with a loss of 17 cents to end at $3.23, Main Event dropped 88 cents to close at $5.62, in exchanging 9,541 units. Paramount Trading ended trading with a loss of 15 cents at $2.05, with 27,433 shares and Stationery and Office traded 10,643 shares with a loss of 20 cents at $8.40. In the Junior Market preference segment, CAC 2000 closed trading at $1, with 1,000 shares changing hands.

of 15 cents at $3.75, with an exchange of 8,100 stock units, Indies Pharma closed at $3.05 trading 104,845 shares. Iron Rock ended 50 cents higher at $5, with 7,000 units trading, Jamaican Teas exchanged 100 shares at $4, Knutsford Express finished trading of 40,878 shares at $12.70, Lasco Distributors closed 11 cents higher at $4, in trading 11,886 shares. Lasco Financial ended 10 cents higher at $4.60, with 3,196 shares traded, Lasco Manufacturing concluded trading of 23,455 stock units, with a loss of 17 cents to end at $3.23, Main Event dropped 88 cents to close at $5.62, in exchanging 9,541 units. Paramount Trading ended trading with a loss of 15 cents at $2.05, with 27,433 shares and Stationery and Office traded 10,643 shares with a loss of 20 cents at $8.40. In the Junior Market preference segment, CAC 2000 closed trading at $1, with 1,000 shares changing hands.

close at $23, with 660 shares changing hands. Jamaica Stock Exchange closed trading with 1,011,290 units changing hands compared to 2,677,014 units on Friday with a decline of 35 cents to $12.65, JMMB Group fell 49 cents to close at $32.50, trading 2,333,919 shares, Proven Investments dropped $8 trading 893,487 units to close at $28. Sagicor Group rose 49 cents trading just under 5.6 million stock units, to close at $39.99, Salada Foods dropped $4 to $38 in trading 10,084 units, Scotia Group climbed $3.67 and finished trading of 4,982,116 shares at $53.97 and Seprod lost 48 cents to end at $33.02 with an exchange of 22,224 shares.

close at $23, with 660 shares changing hands. Jamaica Stock Exchange closed trading with 1,011,290 units changing hands compared to 2,677,014 units on Friday with a decline of 35 cents to $12.65, JMMB Group fell 49 cents to close at $32.50, trading 2,333,919 shares, Proven Investments dropped $8 trading 893,487 units to close at $28. Sagicor Group rose 49 cents trading just under 5.6 million stock units, to close at $39.99, Salada Foods dropped $4 to $38 in trading 10,084 units, Scotia Group climbed $3.67 and finished trading of 4,982,116 shares at $53.97 and Seprod lost 48 cents to end at $33.02 with an exchange of 22,224 shares. The Junior Market index of the Jamaica Stock Exchange climbed by a strong 45.78 points to closed at 3,189.56 at the end of trading on Monday as the prices of 8 securities rose, 6 declined and 7 remained unchanged.

The Junior Market index of the Jamaica Stock Exchange climbed by a strong 45.78 points to closed at 3,189.56 at the end of trading on Monday as the prices of 8 securities rose, 6 declined and 7 remained unchanged.

General Accident traded 18 cents higher at $4, with 8,050 shares changing hands, GWest Corporation finished trading 48,353 shares with a loss of 5 cents at $1.45, Honey Bun closed at $3.90, with 8,672 stock units trading, Indies Pharma closed at $3.05 trading 20,959 shares. Jamaican Teas finished trading 2,316 shares at $4. Knutsford Express finished trading 3,200 shares at $12.70, Lasco Distributors gained 9 cents to close at $3.89, trading 62,066 shares, Lasco Financial ended with a loss of 10 cents at $4.50, with 84,924 shares changing hands, Lasco Manufacturing concluded trading of 500 stock units and rose 12 cents to close at $3.40. SSL Venture Capital rose 5 cents in exchanging 567,557 shares to close at $1.75 and Stationery and Office closed at $8.60, with 16,300 shares changing hands.

General Accident traded 18 cents higher at $4, with 8,050 shares changing hands, GWest Corporation finished trading 48,353 shares with a loss of 5 cents at $1.45, Honey Bun closed at $3.90, with 8,672 stock units trading, Indies Pharma closed at $3.05 trading 20,959 shares. Jamaican Teas finished trading 2,316 shares at $4. Knutsford Express finished trading 3,200 shares at $12.70, Lasco Distributors gained 9 cents to close at $3.89, trading 62,066 shares, Lasco Financial ended with a loss of 10 cents at $4.50, with 84,924 shares changing hands, Lasco Manufacturing concluded trading of 500 stock units and rose 12 cents to close at $3.40. SSL Venture Capital rose 5 cents in exchanging 567,557 shares to close at $1.75 and Stationery and Office closed at $8.60, with 16,300 shares changing hands.